Section 83(b) Elections: What Startup Founders Need to Know

04/29/25

If you are a startup founder or an early employee receiving equity in a company that vests over time, an election can be made under Section 83(b) of the Internal Revenue Code of 1986 (the “IRC”) (a “Section 83(b) Election”) in certain instances to minimize federal income tax liabilities. This update provides a general overview of how the Section 83(b) Election works, its potential benefits, and why a Section 83(b) Election can be especially relevant in the startup and venture capital world.

What is a Section 83(b) Election?

Under IRC §83, when a service provider is granted restricted stock (or other restricted equity interest) that is subject to a “substantial risk of forfeiture” (meaning the service provider must continue to provide services or meet certain conditions to avoid losing, or forfeiting, the equity), the recipient generally will not recognize taxable income from this grant until the interest in the equity vests. At each vesting event, the holder of the restricted equity must report ordinary income based on the difference between the fair market value of the equity at the time that it vests and the amount paid (if any) for the equity.

The Section 83(b) Election provides an exception to this default timing. By filing a Section 83(b) Election, a taxpayer can elect to be taxed immediately based on the current fair market value of the equity at the time it is granted (for both the vested and unvested portion). This requires the tax to be paid in the year of the grant, typically when the equity has low or nominal value, and not in the year in which the service provider’s interest in the equity vests.

What are the Benefits of a Section 83(b) Election?

Filing a Section 83(b) Election can be beneficial for the following reasons:

- Tax on Initial Value: A Section 83(b) Election allows a taxpayer to pay income tax based on the fair market value of the equity at the time of grant, rather than as is vests. By doing so, a recipient of restricted equity can effectively “lock in” the current value of the equity for tax purposes and avoid being taxed on potentially higher values at each vesting period in the future. This can be especially advantageous if the equity in the entity is granted at an early-development stage when the equity has a low valuation but is expected to have its value appreciate over time as the business develops.

- No Surprise Tax at Vesting: Once a Section 83(b) Election is filed, each future vesting event becomes non-taxable. There will be no sudden or unexpected income tax liability each time an interest in equity vests in the future.

- Long Term Capital Gain: Making a Section 83(b) Election establishes the beginning of the taxpayer’s holding period in the equity for purposes of determining whether a future sale of the equity qualifies for long-term capital gain tax rates. This avoids tracking the holding periods for different equity interests based on each applicable vesting date. Therefore, if a taxpayer holds the restricted equity for more than one year from the date of the grant, any gain from a subsequent sale generally would qualify for long-term capital gain tax rates, which are typically lower than ordinary income tax rates (currently the highest long-term capital gain tax rate is 20%, while the highest marginal income tax rate for ordinary income is 37%).

Practical Example

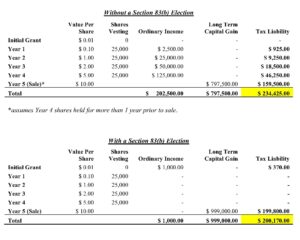

Scenario: A startup founder is granted 100,000 restricted shares of stock subject to 4-year vesting. The company’s value increases substantially each year. In Year 5, the founder sells all 100,000 shares at $10.00 per share.

Assuming the maximum 37% ordinary income tax rate and 20% long-term capital gain tax rate apply:

Estimated total federal income tax savings for the founder as a result of the Section 83(b) Election in this scenario: $34,255.00.

In this scenario, the Section 83(b) Election not only reduced the founder’s total federal income tax liability over the 5-year period but also eliminated the need for the founder to pay thousands of dollars in income tax payments each year upon vesting events before the sale of the stock.

Why Section 83(b) Elections Matter for Startups

Section 83(b) Elections can be particularly relevant in the startup and venture capital space due to the unique characteristics of early-stage equity.

- Founder and Key Personnel Equity Vesting: Startup founders and early key team members often agree to receive restricted equity with vesting schedules to meet investor expectations and align their incentives with the company’s long-term growth. This structure often subjects the recipient to a “substantial risk of forfeiture,” which generally qualifies the equity grant for Section 83(b) Election treatment.

- Low Initial Value and High Growth Potential: Startups typically issue founder or early employee equity at a time when the company’s valuation is minimal (often pennies per share), yet the upside potential is significant. A Section 83(b) Election allows recipients of restricted equity to pay income tax upfront (when value is usually at its lowest) and avoid future income tax on the equity when it could be worth exponentially more.

- Long Term Commitment: Founders and core team members often have a long-term commitment to the company, meaning they’re likely to remain through their vesting schedules. This lowers the risk of forfeiting unvested equity, which can make the Section 83(b) Election’s upfront tax more economically viable.

Filing Requirements

To make a valid Section 83(b) Election, the service provider must file the election with the IRS within 30 days of the date the restricted equity is granted. This deadline is strict, with no ability for extensions, and missing this deadline means forfeiting the opportunity to make the election. Historically, taxpayers were required to submit a custom-written letter containing specific information to make the election in order to comply with IRS regulations. However, in late 2024, the IRS released Form 15620, which is designed to formalize and simplify the Section 83(b) Election process. Taxpayers can still make a Section 83(b) Election via a written statement as before, but using the new form may help to ensure all required information is included.

Other Considerations

For startup founders, a Section 83(b) Election can be a highly effective tax strategy, especially when the restricted equity value at the grant date is low and there is a strong potential for growth. That said, making the election is not without risk. If the equity is forfeited or loses value, a party that makes a Section 83(b) Election could end up paying income tax on income that is never received, with no ability to recover that cost. The decision whether to file a Section 83(b) Election should be evaluated carefully based on each taxpayer’s specific circumstances, including the stage of the company, the type of equity being granted, and the long-term plans of both the company and the recipient of the restricted equity.

To discuss whether a Section 83(b) Election makes sense for you or your team, please contact your Bodman attorney or one of the authors, Ryan Washburn or Wayne Roberts. Bodman cannot respond to your questions or receive information from you without establishing an attorney-client relationship and clearing potential conflicts with other clients. Thank you for your patience and understanding.